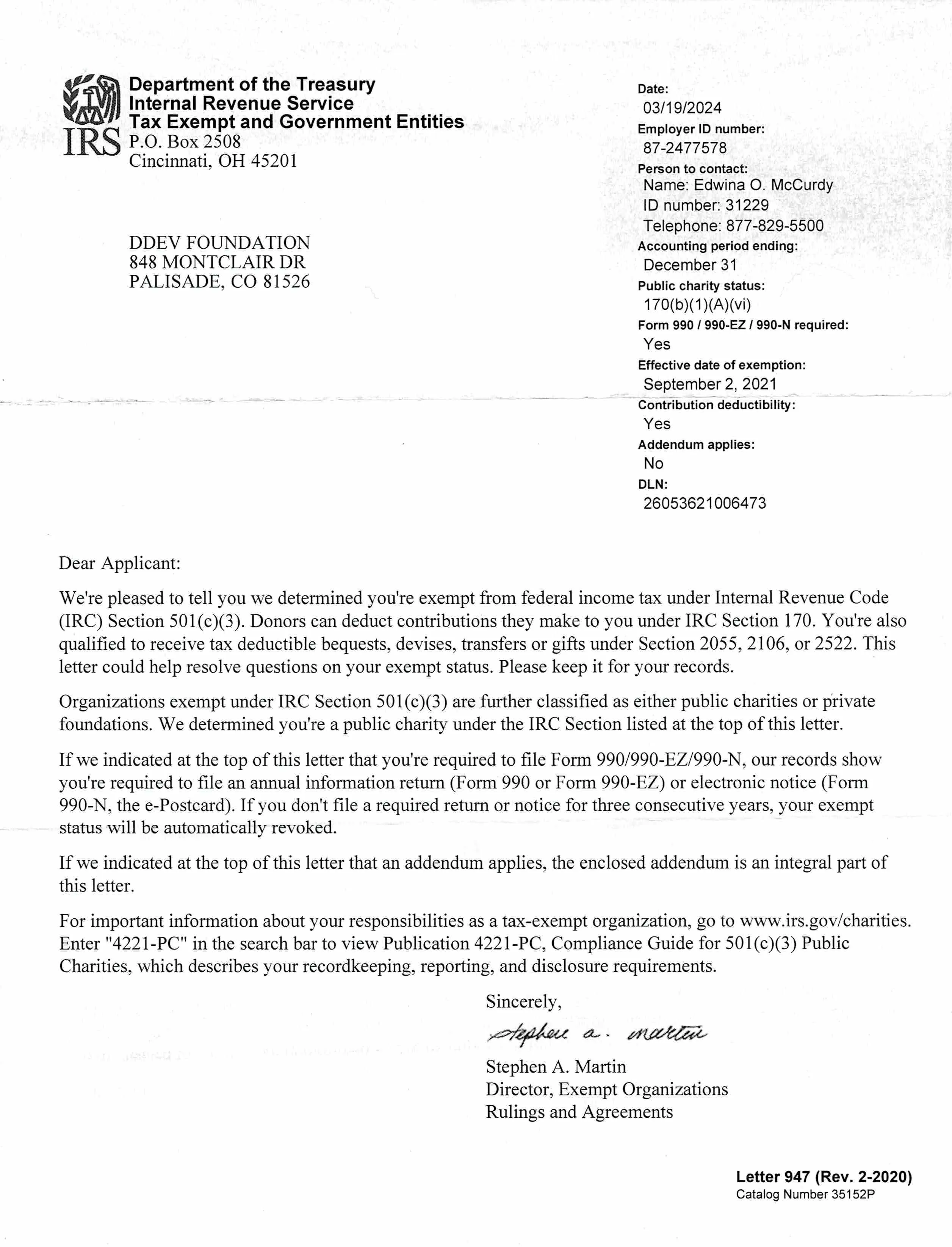

DDEV Foundation gets US nonprofit status (501(c)(3))

The DDEV Foundation is now officially a US Nonprofit (501(c)(3)) organization.

This is great for DDEV because we can receive grants or other benefits that are allowed only for nonprofits.

It’s great for a some US individuals and companies because donations to the DDEV Foundation may be tax-deductible.

Companies providing support to DDEV do not normally get much benefit from this, because DDEV support is usually an expense which counts against their income. However, there may be some donation situations where a company would want the tax deduction instead (although it usually has less value than reporting an expense).

US individuals providing direct support to the DDEV Foundation can write off the donation on their federal income tax return. However, to do I think the support must be provided directly to the DDEV Foundation, and not via GitHub.

Thanks to all of you for working toward realizing our goal of a sustainable project! For more information about how you can support the project, the various ways are explained in sponsors page. See more about our long-term financial goals at Expanding the DDEV maintainer team - how we’ll fund it.